ESG Investing: What’s the Verdict?

Categorized as: About us, Stories on March 26, 2022.

Photograph courtesy of Angela Benito on Unsplash.

Editor’s Note: In 2019, Skees Family Foundation took a deep dive into how we were investing our portfolio, how exactly we were invested, and whether our asset management firm was doing all it could to promote socially responsible investing. As part of that examination, we researched other firms, asked for requests for proposals (RFP’s) from some, as well as one from our own firm. We began to think about more than just negative screening and considered taking a more proactive investing position that was more aligned with our mission of poverty alleviation.

In early 2020, the board voted on a new investment policy that included focused investing in Environmental, Social, and Governance (ESG) funds. Based upon the long discussions, research, and the recommendations of our asset management firm, we reallocated our investments to include 100% ESG-focused funds and bonds. Much of our investments also have a global theme, in keeping with the international concentration of our grantmaking.

While we have been pleased with the growth of our own portfolio over the past two years, we were wondering how the whole ESG investing landscape was developing. As socially responsible investing becomes more and more important to investors, there is recent criticism that many companies “greenwash” and are overly effusive with their claims of social responsibility.

By Sally Skees-Helly, President and Director

By Sally Skees-Helly, President and Director

ESG is Everywhere These Days

It seems everyone is now interested in socially responsible investing, especially younger investors who include responsibility along with risk and return in their investing philosophy. According to the latest biennial Global Sustainable Investment Review, at the start of 2020, ESG investments had grown to $35.3 trillion, and made up 35.9% of assets under management. No doubt those numbers have grown since. However, critics charge that the definition of ESG is subjective and vague at best and that regulation thus far is limited. Many corporations profess to hold ESG principles in high regard, yet with just a bit of digging, it is clear their products, policies, and values are anything but.

For a great take on where ESG has been, where it is going, and separating fact from fiction when it comes to ESG investing, check out this twenty minute podcast with Clare Golla and Travis Allen of Bernstein Wealth Management.

ESG Performance: Has it Kept Up in Performance?

As many investors consider ESG investing, they appropriately wonder if you must accept a lower rate of return to be socially responsible. The good news is that ongoing research shows that ESG has performed very similarly to non-ESG investments. According to a Morningstar article, ESG’s have consistently performed around the middle of their peer groups.

With regard to risk, ESG funds have also shown to have about the same standard deviation of returns as their peers. The same Morningstar article noted that over the past one-, three-, five, and ten-year periods showed no evidence that ESG funds were riskier than other funds.

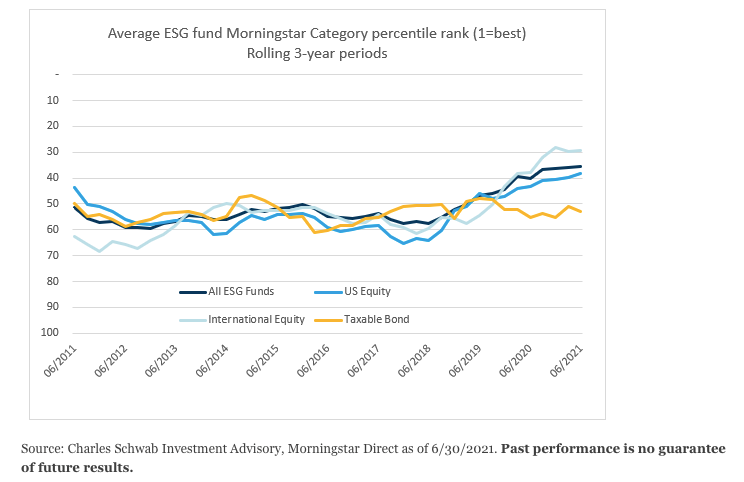

A fund that ranks in the first percentile for a three-year period has done better than all of the other funds, and one that ranks in the 100th percentile has done the worst of all of its peers. ESG funds rank consistently in the middle of their peer group. According to Morningstar, “if ESG funds were at a natural disadvantage, these lines would be toward the bottom of the chart, but if anything, ESG funds have done a bit better than average overall.”

NYU Stern Center for Sustainable Business and Rockefeller Asset Management produced a report that examined the relationship between ESG and financial performance by aggregating the results of over 1000 studies between 2015 and 2020. Although the report is rather long, they drew six conclusions:

- Improved financial performance due to ESG becomes more marked over longer time horizons.

- ESG integration as an investment strategy seems to perform better than negative screening approaches.

- ESG investing appears to provide downside protection, especially during a social or economic crisis.

- Sustainability initiatives at corporations appear to drive better financial performance due to mediating factors such as improved risk management and more innovation.

- Studies indicate that managing for a low carbon future improves financial performance.

- ESG disclosure on its own does not drive financial performance.

What About Defining and Regulating ESG’s?

Although global regulation has been slow in coming, governments are increasingly moving to standardize ESG regulations and reporting, especially around climate change. According to Jesse Chen, AVP and Head of ESG & Sustainability, Water, and Wall, “the next five years will see regulations beginning to take effect and more and more countries will be joining the movement”. In January of this year, Europe introduced the EU’s Taxonomy Climate Delegated Act, screening corporate activities for climate change mitigation and adaptation. The US Department of Labor is also in the process of passing new rules that allow fiduciaries to consider climate change and other ESG factors when they select investments and exercise shareholder rights. Although the majority of regulations at this time are directed more toward climate change than other ESG factors, investors, and governments both seek to move toward global reporting standards across the board.

As ESG becomes more defined and regulated and continues to grow in both dollars invested and general awareness, it is predicted that ESG options will be offered in retirement plans more often as companies step up to pressure from their employees to offer socially responsible retirement savings options.

All in all, the inclusion of socially responsible investing seems to be trending positively, and criticisms are being addressed. As the ESG movement becomes more mainstream and standardized, perhaps the whole sector will eventually consider responsibility as just as important as risk and return in their investing strategy, forcing corporations to actually do the same.

SHARE this story with your networks; see menu at top and bottom of page.

SUBSCRIBE! Like what you see? Click here to subscribe to Seeds of Hope!